The Ardonagh Group (‘Ardonagh’ or the ‘Group’) today announces its financial results for the 12 months ending 31 December 2024.

Financial highlights

- Pro forma income of $2.5 billion and Pro forma Adjusted EBITDA of $941 million, including completed and committed acquisitions to 17 March 2025, together with annualised growth and savings initiatives

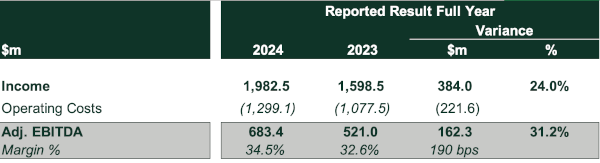

- Reported income rose by 24% to $1.99 billion, Reported Adjusted EBITDA grew by 31% to $683 million, with Reported Adjusted EBITDA margin growth of 190bps to 34.5%, all vs. comparable period prior year

- Organic income growth of 8% on a constant currency basis

- 68 acquisitions completed during the year, including the public to private purchase of PSC Insurance Group, Ardonagh’s largest acquisition to date, and 62 add-on acquisitions across multiple geographies

- Successful refinancing of group borrowings completed February 2025, reducing the average cost of debt from 9.3% in FY23 to 7.5% and simplifying capital structure.

Group highlights

- Strong demand for equity investment round led by Stone Point Capital at an enterprise valuation of $14 billion

- Completion is expected to take place in mid-2025, at which point Stone Point will become a significant shareholder in Ardonagh, alongside Madison Dearborn Partners (“MDP”), HPS Investment Partners (“HPS”), as well as co-investors including a wholly owned subsidiary of the Abu Dhabi Investment Authority (“ADIA”) and several other large institutions

- Strategy executed via five regional platforms; UK Advisory, Europe, Envest in APAC, MDS in Latin America and Rest of World, and Specialty

- Launched Ardonagh Intelligence, bringing together the best of robotics, machine learning, and data insight from across the Group

- Ardonagh today publishes its 2024 Sustainability Report detailing a diverse range of ESG achievements including over $7million raised to date by our registered charity, ACT, and million-pound milestones for our community grant and colleague match-funding programmes.

Currency translated at 1.26 USD/GBP

Group Chief Executive Officer David Ross commented: “2024 was a coming of age for Ardonagh. We started the year with a successful refinancing, completed the merger of our retail business Atlanta with Markerstudy, and took PSC Insurance Group private in our biggest acquisition to date. All while continuing to strengthen our position in the UK and executing a targeted M&A strategy in our chosen markets globally.

“Our established P&C platforms are well positioned for continued organic growth, and our Specialty business is reaping the benefits of new hires, placement initiatives and its connections with the broader Group.

“We ended a terrific year with Stone Point Capital’s agreement to invest into Ardonagh at a valuation of $14 billion.

“Stone Point’s investment is a huge achievement for our 12,000 people that provides the security, stability and control of destiny that comes from being a private company for years to come.”

Group Chairman John Tiner commented: “Though in our seventh year as a united group, Ardonagh’s roots grow far deeper. We celebrated the 20th anniversary of Arachas, while MDS marked its 40th year. Both businesses are leaders in their respective markets of Ireland, and Portugal and Brazil, and we are delighted to back their continued success.

“We entered Spain and New Zealand for the first time, and in total welcomed more than 1,500 new colleagues from the 68 deals completed across the year. With this growth in our footprint comes yet more specialist expertise and innovative thinking to bring to the clients and communities we serve.

“The lessons gathered in the journeys of all our companies contribute to a living legacy for our combined Group – which is today being used to drive our path towards high-quality growth and earnings, and an exciting future for a truly global enterprise.”

ENDS

1) Reported result which includes acquisitions and disposals from the completion date.

2) “Adjusted EBITDA” or “Adj. EBITDA”; defined as EBITDA after adding back discontinued operations, restructuring costs, Transformational Hires, Business Transformation Costs, Legacy Costs and Other Costs, regulatory costs, acquisition and financing costs, profit/loss on disposal of businesses or investments, share of operating profit/loss from associate, reduction/increase in the value of contingent consideration, as applicable. Adjusted EBITDA is stated before exceptional costs and one-off items as determined by management.

For more information, please contact ardonagh@sodali.com

NOTES TO EDITORS

THE ARDONAGH GROUP

The Ardonagh Group is one of the world’s largest independent insurance distribution platforms and a top 20 global broker. We are a collection of best-in-class entrepreneurial and specialist brands with a combined workforce of over 12,000 colleagues and a network spanning 200+ locations in more than 30 countries. Across our portfolio, we offer a highly diversified range of insurance-related products and services across the full insurance value chain globally. From complex multinational corporations to individuals purchasing personal insurance policies, our understanding of the communities we serve, together with our scale and breadth, allows us to work with our insurer partners to deliver a broad range of product and risk solutions that meet customer needs.