The Ardonagh Group (‘Ardonagh’ or ‘the Group’) today announces its full year results covering the twelve months to 31 December 2021.

Group Highlights:

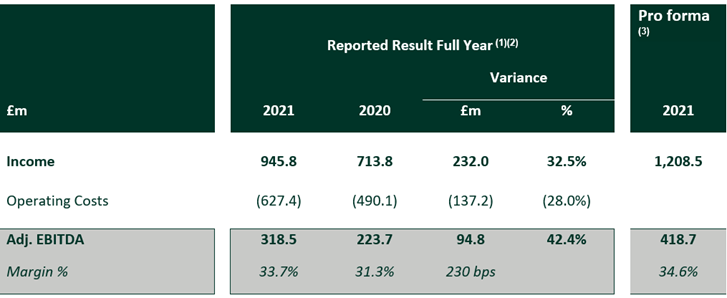

- Reported income rose by 32.5% to £945.8 million ($1.3 billion), underpinned by organic growth of 7.3%.

- Adjusted EBITDA increased by 42.4% from £223.7 million ($309.1 million) to £318.5 million ($440.1 million).

- Pro forma for contractually committed acquisitions and cost savings, income was £1.2 billion ($1.7 billion) and Adjusted EBITDA £418.7 million ($578.5 million).

- Disciplined, rigorous and efficient M&A process yielded 27 acquisitions during the year at an average multiple of 6.5x post revenue and cost synergies.

- Operating Cash Conversion maintained at 95% or over for the last two years.

- Eight-fold income growth in Ardonagh International from £22m in 2020 to £188 million pro forma income in 2021.

- Acquisition of Ed Broking Group and Besso Insurance completed in November 2021, creating the largest independent London Market broker.

- In December 2021, Ardonagh was valued at $7.5 billion as part of a significant new equity investment led by existing long-term shareholders MDP and HPS Investment Partners.

Chairman John Tiner commented: “Once again The Ardonagh Group has made exceptional progress in strengthening its position as a leading international insurance intermediary business, successfully managed a number of challenges emerging from the external environment, furthered its contribution to the societies and communities which we live and work in, and improved its financial performance.

“Our leadership teams across the platforms work together cohesively with numerous examples of customers benefitting from this approach and creating processes and solutions across the Group which represent the ‘best of the best’ within it.

“The support of our shareholders, HPS Investment Partners and MDP has remained a constant since the Group’s formation. We were delighted that in December 2021 they renewed their commitment to the Group. Co-investors, including a wholly owned subsidiary of the Abu Dhabi Investment Authority, and several other large global institutions, will also acquire more than $1 billion equity through accounts managed by MDP and HPS as part of the transaction*.

“The Group has an ambitious programme of growth over the next several years and the stability and quality of our shareholder base, together with our lending partners, provides the foundation for achieving these plans.”

CEO David Ross commented: “The Group we have built is unique in our industry both because of our diversification and our operating model, with each of our platforms operationally integrated, independent, and yet culturally invested in each other.

“Our ability to amplify the best of our collective experience, use our combined size to our clients’ benefits, and retain the flair of the businesses and people that join us is behind the numbers we report today.

“The strength of our model was resoundingly endorsed by new equity investment led by our long-term shareholders, which we announced at the end of 2021, valuing the Group at $7.5 billion and representing a firm commitment to our independence for years to come.

“2021 was also a defining year because of the transformational acquisitions we made to expand our model internationally. During the year we launched Ardonagh International with the creation of Ardonagh Global Partners and Ardonagh Europe. We welcomed colleagues from Australia and the USA and were privileged to end the year with an agreement to acquire MDS Group*, a renowned global platform and our largest international acquisition to date.

“With Ed Broking, Besso and Piiq Risk Partners joining Price Forbes, Bishopsgate, Compass London Markets and Inver Re in November, Ardonagh Specialty has become the largest independent broking platform in the London Market.

“Throughout our platforms, supporting our colleagues remains a top priority. We invest heavily in training and development, in women in leadership initiatives, and are focused on mental and physical wellbeing as our work practices have changed.

“In our new hybrid way of working prioritising time to connect with each other has never been more important. We were therefore pleased to see high positivity scores across the business in our recent colleague engagement survey. Our people said they felt inspired to do the best that they can, that they feel proud to be part of Ardonagh and that their part of the Group has a strong sense of direction.

“Our Group survived an extraordinary test of character in 2020 and 2021 and came out stronger, with a record breaking year of fundraising for the Ardonagh Community Trust that points to the engagement and strength of culture in our Group.

“2021 has laid the foundations for a very exciting period of the Group. We enter 2022 with strength and an abundance of opportunity to consolidate our base in the UK and Ireland, forge new connections across the globe and deepen connections with each other.”

* Completion subject to regulatory approval

1) Reported result which includes acquisitions and disposals from the completion date.

2) “Adjusted EBITDA” or “Adj. EBITDA" defined as EBITDA after adding back discontinued operations, restructuring costs, Transformational Hires, Business Transformation Costs, Legacy Costs and Other Costs, regulatory costs, acquisition and financing costs, profit/loss on disposal of businesses or investments, share of operating profit/loss from associate, reduction/increase in the value of contingent consideration, as applicable. Adjusted EBITDA is stated before exceptional costs and one-off items as determined by management.

3) Pro forma for all acquisitions completed and contractually committed to 23 March 2022 and including the annualisation of cost savings and cost synergies from completed actions and actions expected to be completed during 2022.

Notes to Editors

THE ARDONAGH GROUP

The Ardonagh Group is the UK’s largest independent insurance distribution platform and a top 20 broker globally. We are collection of best-in-class entrepreneurial and specialist brands with a network of more 100 locations and a combined workforce of more than 9,000 people. Across our portfolio, we offer a highly diversified range of insurance-related products and services across the full insurance value chain in the UK, Ireland and broader international markets. From complex multinational corporations to individuals purchasing personal insurance policies, our understanding of the communities we serve, together with our scale and breadth, allows us to work with our insurer partners to deliver a broad range of product and risk solutions that meet customer needs.

Latest announcements

Bendigo Insurance Brokers Pty Ltd joins forces with Envest

Bendigo Insurance Brokers Pty Ltd, a trusted name in the Bendigo community for over 35 Years, is pleased to announce a new partnership with The Envest Group. Envest, has acquired a majority stake in the business and adds Bendigo Insurance Brokers to its growing network of Aviso Group brokers.

MDS announces its first acquisition of a broker in Spain

The MDS Group (“MDS”), part of The Ardonagh Group, has announced it has agreed to acquire insurance broker Cobian Insurance Brokers (“Cobian”). Founded in 2018, and headquartered in Madrid, Cobian has a focus on commercial insurance, particularly in industrial risks, energy, construction and financial lines. Pablo Cobián, CEO of Cobian Insurance Brokers will continue to be part of the management team, driving growth in the Spanish market.