The Ardonagh Group (‘Ardonagh’ or ‘the Group’) today announces its results covering the three months to 31 March 2022.

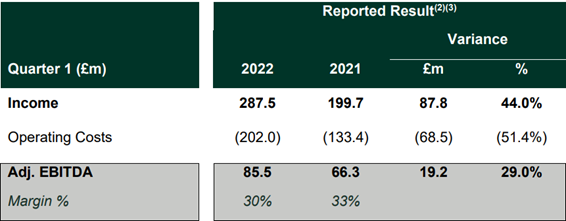

Group total income increased by 44% from £200 million ($270 million) to £288 million ($389 million) in the first quarter of the year and Adjusted EBITDA by 29% to £86 million ($116 million).

Organic income growth across the group was 8.2% in the quarter.

The Group invested £15 million in growth drivers during the quarter, including new hires, IT system improvements and projects which will deliver new business together with long term savings and synergies.

Operating cash conversion remained strong at 91% and unlevered free cash flow(1) was £218 million ($295 million) for the 12 months to 31 March 2022. The Group had £688 million ($930 million) available liquidity as of 31 March 2022.

Group CEO David Ross commented: “The momentum behind the group continued in the first three months of the year with strong execution on organic growth, operational efficiency and group-wide opportunities together with fast growth in Specialty and International.

Our pipeline of potential acquisitions and producer hires is robust as businesses and people seek environments where entrepreneurialism and a client-focused culture meet scale.”

- Unlevered Free Cash Flow defined as cash flow after investments and tax, but before interest, M&A and other financing cash flows

- Reported result which includes acquisitions and disposals from the completion date.

- “Adjusted EBITDA” or “Adj. EBITDA" defined as EBITDA after adding back discontinued operations, restructuring costs, Transformational Hires, Business Transformation Costs, Legacy Costs and Other Costs, regulatory costs, acquisition and financing costs, profit/loss on disposal of businesses or investments, share of operating profit/loss from associate, reduction/increase in the value of contingent consideration, as applicable. Adjusted EBITDA is stated before exceptional costs and one-off items as determined by management.

Notes to Editors

THE ARDONAGH GROUP

The Ardonagh Group is the UK’s largest independent insurance distribution platform and a top 20 broker globally. We are collection of best-in-class entrepreneurial and specialist brands with a network of more 150 locations and a combined workforce of more than 9,000 people. Across our portfolio, we offer a highly diversified range of insurance-related products and services across the full insurance value chain in the UK, Ireland and broader international markets. From complex multinational corporations to individuals purchasing personal insurance policies, our understanding of the communities we serve, together with our scale and breadth, allows us to work with our insurer partners to deliver a broad range of product and risk solutions that meet customer needs.

Latest announcements

Bendigo Insurance Brokers Pty Ltd joins forces with Envest

Bendigo Insurance Brokers Pty Ltd, a trusted name in the Bendigo community for over 35 Years, is pleased to announce a new partnership with The Envest Group. Envest, has acquired a majority stake in the business and adds Bendigo Insurance Brokers to its growing network of Aviso Group brokers.

MDS announces its first acquisition of a broker in Spain

The MDS Group (“MDS”), part of The Ardonagh Group, has announced it has agreed to acquire insurance broker Cobian Insurance Brokers (“Cobian”). Founded in 2018, and headquartered in Madrid, Cobian has a focus on commercial insurance, particularly in industrial risks, energy, construction and financial lines. Pablo Cobián, CEO of Cobian Insurance Brokers will continue to be part of the management team, driving growth in the Spanish market.