19 April 2018

Strong growth in income and EBITDA

“We started 2017 with a vision, the execution of which delivered a £536 million income company with the broadest client proposition in the market.”

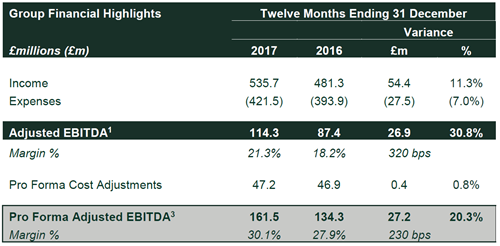

- Adjusted EBITDA up 31%

- Income growth of 11% including 3.5% organic

- £83m investment in selected, highly accretive acquisitions including Carole Nash, Healthy Pets and Mastercover to create the leading independent insurance broker in the UK

- Influx of talent across the organization

The Ardonagh Group (‘Ardonagh’ or ‘the Group’), the UK’s leading, diversified independent insurance broker, today announces its full year results covering the twelve months to 31 December 2017.

Chairman John Tiner commented: “In the short period since the formation of the Ardonagh Group in mid-2017, we have experienced the power of this combination of market leading businesses and how it can deliver outstanding outcomes for our customers, our people and our investors.

Ardonagh has become the new home of independent broking for customers across the personal and commercial spectrum. The Group’s 20 leading customer-facing brands place insurance that underpins the backbone of the UK, from the security of 300,000 UK SMEs; to a quarter of all UK motorcyclists; one third of GP surgeries; all the way through to our specialty global clients in our wholesale business.

The unique cultures and personalities of our businesses continue to flourish under the guidance of their talented management teams. At the same time, they have come together under the Ardonagh umbrella, sharing a common sense of resilience and spirit, and offering a unique perspective across UK insurance. These values have been brought to the forefront in the launch of The Ardonagh Community Trust in November, which has already raised more than £350,000 to support the causes close to the hearts of our employees and clients across the United Kingdom.

With the ongoing support of our shareholders and bondholders, we believe that the platform we have established at Ardonagh will become the destination of choice for market leading intermediary businesses and teams.

GROUP FINANCIAL HIGHLIGHTS

GROUP HIGHLIGHTS

- Income of £536 million with +11% growth vs. prior year driven by successful acquisition strategy, effective hiring of market leading talent and underlying organic income growth of +3.5%

- Investment continues across the Group boosting Pro Forma Adjusted EBITDA by 20.3% to £161.5m

- £83 million highly accretive acquisition spend since the creation of the Group

- £52 million investment in efficiency savings and group synergies and non BAU investments in IT, property and Group infrastructure governance

- £18 million investment to drive continued producer hiring momentum, including Wholesale and MGA strategic hires and account and development executive recruitment in Advisory

- UCIS redress payments of £19 million completed in Q3 2017

- ETV liability provisioned at £51 million, in line with previous guidance, with payments estimated to begin late 2018 over a two-year period

- Net Secured Leverage reduced to 5.2x and available liquidity increased to £133 million as at 31 December 2017

- Deloitte appointed as auditors to The Ardonagh Group following an external tender process

- Impairment in value of Underwriting business as a result of deeper remediation plans than originally anticipated in a tough market as evidenced by broader sector results

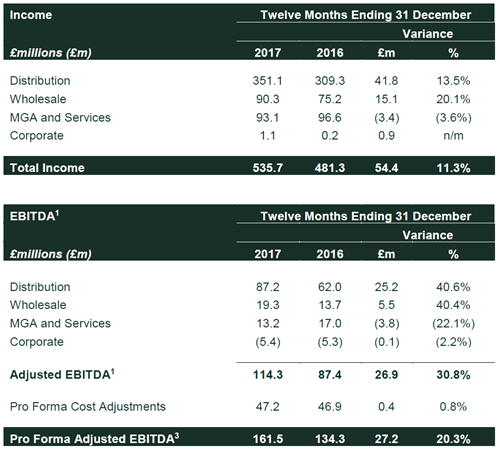

SEGMENTAL FINANCIAL HIGHLIGHTS

SEGMENT OPERATIONAL HIGHLIGHTS

Distribution

- Distribution income growth +14% vs. prior year and underlying Organic growth of +1.5%, despite SBU and market headwinds in Retail

- Advisory delivered strong Organic growth of +3% vs. prior year, driven primarily by new business up +3% and retention up +2pp

- Autonet also delivered strong Organic growth of +3% vs. prior year. Continued strong execution on core business, combined with investments in strategic initiatives supported by the hire of key individuals with proven capability for delivery

- Paymentshield demonstrated excellent performance in its core buildings and contents market and delivered market leading retention of 84%

Wholesale

- Very strong organic growth at +16%

- Broader product and people investments made in the previous eighteen months are beginning to come through, including the addition of US Binders and Worldwide Energy hires which have proven track records

- New product lines added to those already offered, including Cyber, Renewable Energy and Healthcare

MGA & Services

- Successfully launched London Market and European propositions, with all new business lines having secured “A” rated capacity and now actively trading

- Smooth transition of claims handling to Direct Group for Towergate Home and Let portfolios

- UK commercial underwriting business under pressure as remediation initiative is executed and a profitable underwriting culture is embedded. Loss ratios showing continued improvement

- Increasing focus on niche and specialist lines

David Ross, Chief Executive of The Ardonagh Group, commented:

“We started 2017 with a vision, the execution of which delivered a £536 million income company with the broadest client proposition in the market.

The unveiling of The Ardonagh Group may have come as a surprise to many; but a like-minded leadership team who were united in their belief in the vision were focussed on creating something different for this market. The result was a moment in May 2017 when we changed the landscape of UK insurance by bringing together leading businesses to create a new challenger brand.

In early 2016, we presented a twelve-quarter plan to investors and now find ourselves facing into the final stages of that plan. In July of this year, our entire broking operation will have been successfully migrated from in excess of 120 different systems to one broking platform; twelve months ahead of schedule. The culmination of this project effectively finishes the commercial fix of the old Towergate, with the balance of the operational change programs landing in the second half of 2018.

In addition to growth from M&A activity, we have continued the good work started in 2016, maintaining organic investment in the business. Distribution, the core of what we do as an insurance broker, has had a particularly strong year, where the investments made in people, infrastructure and systems in Advisory, combined with the successful execution of a series of efficiency programmes and Autonet’s leading online platform, have boosted Pro Forma Adjusted EBITDA by 41%. In the London Market, where we have seen organic growth of 16%, our wholesale segment is becoming the go-to place for entrepreneurial brokers and clients alike whilst over in Paymentshield, we’ve delivered market leading retention of 84% in the buildings and contents market. A profitable underwriting culture is being embedded in our MGA segment and improving loss ratios are helping to secure long-term capacity and profit commission agreements.

Whilst the first half of the year was about crafting and creating Ardonagh, the second half was about starting to maximise the value of all its component parts. The Group is now entering its next phase with the capacity to strategically invest in value creation as opposed to fixing the business.

2017 was a year of execution for our team, creating a new disruptor in the market and delivering a transformational refinance project, all while keeping a relentless focus on delivering the change program within the old Towergate business. 2018 sees us positioned with a tremendous culture, accelerated organic growth and continued focus on the recruitment of new talent. As we further develop from the platform we have built with this array tools at our disposal, we look to the future seeing ourselves as an outperformer in the market.”

1) We define “Adjusted EBITDA” or “Adj. EBITDA” as the profit or (loss) on ordinary activities before finance costs, income tax, depreciation and amortisation charges, share of loss from an associate and impairment of goodwill, adjusted for loss or (profit) on the disposal of businesses, related party bad debt provision, reduction in value on contingent consideration, group reorganisation costs, regulatory costs, asset write-downs in connection with business restructuring, business investment costs, consultancy on regulatory matters, levy costs and finance legacy review costs, as applicable. Adjusted EBITDA is stated before exceptional costs and one-off items as determined by management. This includes Towergate, Price Forbes, Autonet, Direct Group and Chase Templeton financial results as if owned for the full period shown in the current and prior financial year.

2) We define “Organic” as excluding the impact of acquired or exited businesses and other non-recurring items and is set out at actual FX.

3) We define “Pro Forma Adjusted EBITDA” or “Pro Forma Adj. EBITDA” as the Adjusted EBITDA of each of Towergate, Price Forbes, Autonet, Direct Group and Chase Templeton, each as adjusted for overhead costs currently incurred by The Ardonagh Group, Atlanta Holdco and PF Holdco, certain cost saving initiatives and cost synergies, a USD/GBP FX adjustment related to Price Forbes and certain other transactions adjustments including certain UK GAAP to IFRS adjustments.

Notes to Editors

ABOUT THE ARDONAGH GROUP

The Ardonagh Group is the UK’s largest independent insurance broker with global reach. We are a network of over 100 office locations and a workforce of almost 6,000 people. The Ardonagh Group was created in June 2017, bringing together Autonet, Chase Templeton, Direct Group, Price Forbes and Towergate, with the additional acquisitions of Healthy Pets in August 2017, and Carole Nash and Mastercover announced in December 2017. Our understanding of the communities we serve, together with our scale and breadth, allows us to work with our insurer partners to deliver solutions that meet our customer needs.

Media Queries Internal & External Contact

Email: communications@ardonagh.com

Latest announcements

Ardonagh Advisory builds presence in northwest England with acquisition of SIB Insurance

Ardonagh Advisory has acquired Southport Insurance Brokers Limited (SIB Insurance), an independent commercial broker, further strengthening Ardonagh’s presence in the northwest of England.

Ardonagh Advisory completes acquisition of Westfield Insurance

Further to its announcement in December that it had exchanged contracts, Ardonagh Advisory has completed its acquisition of Westfield Brokers Ltd.