20 May 2020

Continued growth from diversified, resilient business

EBITDA growth and margin improvement in all platforms as operational efficiency builds

The Ardonagh Group (‘Ardonagh’ or ‘the Group’) today announces its results covering the three months to 31 March 2020.

The Group has a unique position as a highly diversified independent insurance broker, negotiating and advising on risk and insurance placements from personal motor to commercial property to US Casualty.

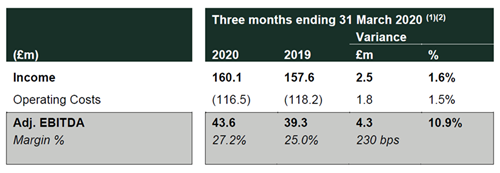

Group income increased by 1.6% to £160.1 million and Adjusted EBITDA by 10.9% to £43.6 million due to accretive investments in growth initiatives, including producer hires, bolt-on acquisitions, and the continued delivery of cost savings.

Ardonagh’s Specialty platform recorded underlying organic growth of 10.7% as prior year investments in hiring new producers reached maturity, resulting in substantial new business wins.

Advisory grew by 6.1% underpinned by niche bolt-on acquisitions and continued strong organic growth across Towergate Insurance Brokers, Health and Protection and Footman James.

Underlying organic growth in Retail, excluding Swinton, was 0.9%, driven by improved retention, whilst Adj. EBITDA increased from £18.4 million to £20.1 million with significant cost reductions from the Swinton integration programme.

The COVID-19 pandemic and lockdown measures have had a limited impact on Ardonagh. The substantial investment into upgrading processes and systems over the last three years made it possible for 90% of our workforce to work from home, advising clients securely and remotely.

Ardonagh Group CEO David Ross said:

“Following a strong 2019 we have seen continued underlying growth across our diversified platforms.

“The ingenuity and determination of our people means we will continue to serve our clients as they adapt to the changes to the way they live and do business.

“Businesses and individuals need insurance brokers on their side more than ever. Our people have risen to the challenge, helping to negotiate on claims, sourcing lower premiums for car and home customers, and delivering quality risk management advice and insurance programmes for businesses as they evolve.

“Customers have rewarded the solutions-focused flexibility of Ardonagh with increased retention, which is the ultimate endorsement of our work.

“Trading since the Q1 close, during which the national lockdown has been in place throughout, has continued to be resilient, and costs have continued their downward trajectory.”

1) Reported result which includes acquisitions and disposals from the completion date.

2) “Adjusted EBITDA” or “Adj. EBITDA" defined as EBITDA after adding back discontinued operations, restructuring costs, Transformational Hires, Business Transformation Costs, Legacy Costs and Other Costs, regulatory costs, acquisition and financing costs, profit/loss on disposal of businesses or investments, share of operating profit/loss from associate, reduction/increase in the value of contingent consideration, as applicable. Adjusted EBITDA is stated before exceptional costs and one-off items as determined by management.

Notes to Editors

THE ARDONAGH GROUP

The Ardonagh Group is the UK’s largest independent insurance broker with global reach. We are a network of over 100 office locations and a workforce of nearly 7,000 people. Formed in 2017 and following a series of acquisitions in 2018, Ardonagh today brings together best-in-class brands including Autonet, Bishopsgate, Carole Nash, Geo Underwriting, Price Forbes, Swinton, Towergate and URIS. Our understanding of the communities we serve, together with our scale and breadth, allows us to work with our insurer partners to deliver solutions that meet our customer needs.

Media Queries External Contact

Email: communications@ardonagh.com

Investor Relations Contact

Karen Noakes - Corporate Finance and Investor Relations Director

Email: karen.noakes@ardonagh.com

Latest announcements

Ardonagh Advisory builds presence in northwest England with acquisition of SIB Insurance

Ardonagh Advisory has acquired Southport Insurance Brokers Limited (SIB Insurance), an independent commercial broker, further strengthening Ardonagh’s presence in the northwest of England.

Ardonagh Advisory completes acquisition of Westfield Insurance

Further to its announcement in December that it had exchanged contracts, Ardonagh Advisory has completed its acquisition of Westfield Brokers Ltd.